🔍 What Is Figma and Why Is Everyone Talking About FIG Stock?

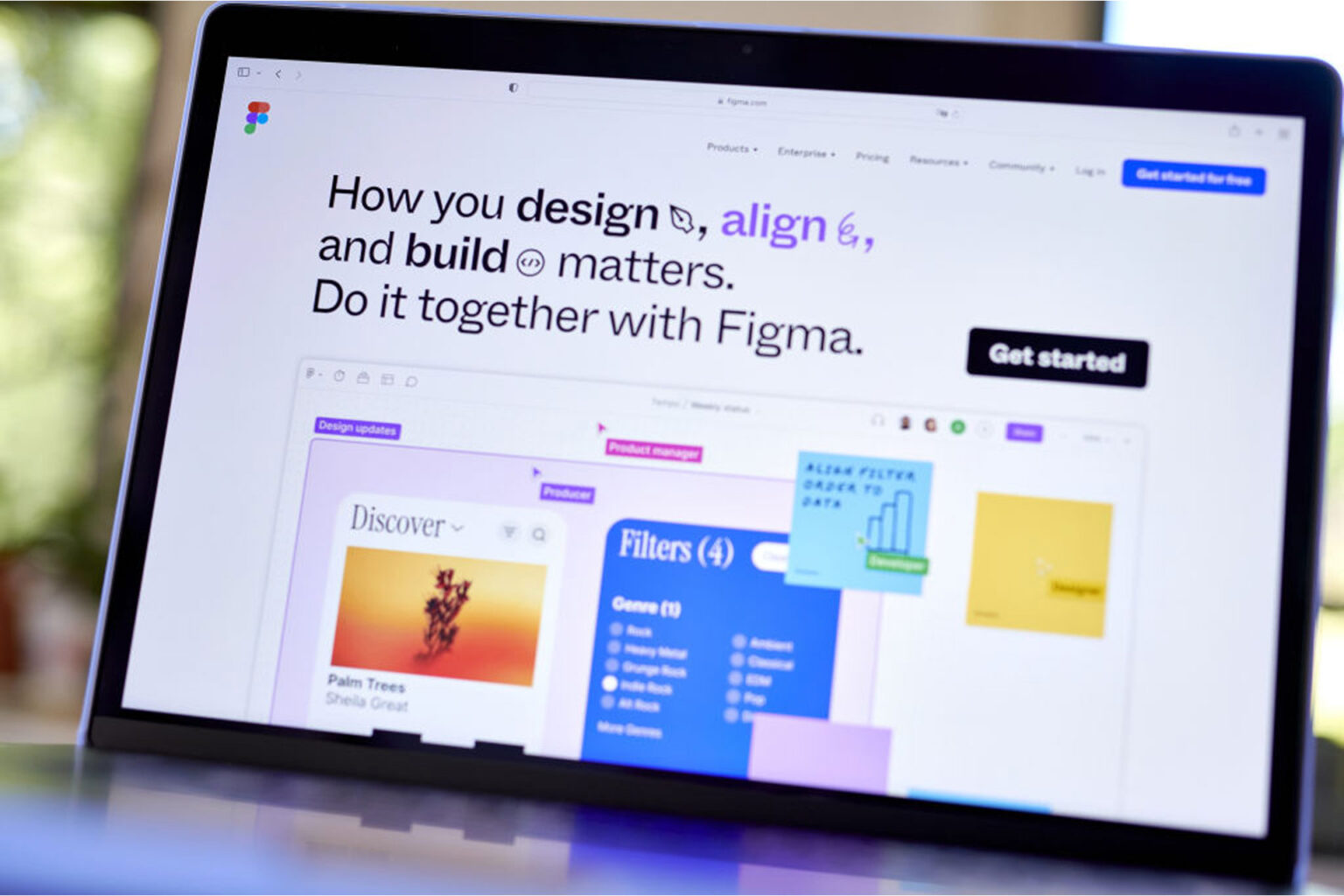

Figma is a collaborative web-based interface design tool that has become a favorite among UX/UI designers, product managers, and development teams worldwide. Since its launch in 2016, Figma has revolutionized the design space with its cloud-native platform, allowing real-time collaboration—similar to how Google Docs transformed document editing.

But now, all eyes are on FIG stock, the proposed ticker symbol for Figma’s upcoming IPO. With the design tech industry growing rapidly, Figma’s potential market debut is being watched closely by investors, tech enthusiasts, and Silicon Valley insiders alike.

💡 Why Figma Matters: The Design Tool That Disrupted Adobe

Figma quickly became a disruptive force in the design world, taking on giants like Adobe. With its browser-based solution and intuitive real-time collaboration features, it attracted major enterprise clients, including Microsoft, Uber, Zoom, and GitHub.

So powerful was its rise that Adobe announced plans to acquire Figma in 2022 for $20 billion—a move that shook the industry. However, due to antitrust concerns from regulators in the EU and UK, the deal was eventually called off in late 2023.

This development opened the door for a standalone Figma IPO—and thus, interest in Figma stock skyrocketed.

🔗 Read about the canceled Adobe-Figma deal on CNBC

🚀 Figma IPO: What We Know So Far

Though Figma hasn’t officially filed its S-1 as of July 2025, several reports indicate that the company is actively preparing for an IPO under the ticker FIG.

Key IPO Rumors and Projections

| Category | Details |

|---|---|

| Ticker Symbol | FIG |

| Expected IPO Date | Q4 2025 (speculative) |

| Expected Valuation | $12B–$14B (down from $20B offer by Adobe) |

| Lead Underwriters | Goldman Sachs, Morgan Stanley (rumored) |

| Exchange Listing | NASDAQ |

Some insiders speculate that the Figma stock IPO price could be between $35 and $50 per share, depending on final valuation and market conditions. However, nothing is confirmed until the company files publicly.

🔗 More on IPO valuation trends at Crunchbase

📊 Financial Overview: Figma’s Revenue and Growth

Figma has demonstrated strong financials even in a competitive SaaS environment. While the company has not publicly disclosed all its financial data, some key figures have been leaked:

-

Annual Recurring Revenue (ARR): Estimated at over $600 million in 2024

-

Customer Growth: Over 4 million users worldwide

-

Freemium Model Success: A large base of free users eventually converting to paid enterprise plans

Figma’s revenue model—based on per-seat licensing—scales well with enterprise adoption, leading to strong recurring revenue streams.

💡 According to sources like The Information, Figma’s revenue grew over 80% YoY in 2023, making it one of the fastest-growing SaaS firms.

💼 Who Owns Figma?

Figma was founded by Dylan Field and Evan Wallace, both computer science graduates from Brown University. After raising over $333 million from investors like Sequoia Capital, Index Ventures, and Andreessen Horowitz, the founders and early backers hold significant equity.

Upon IPO, large shareholders like Sequoia are expected to cash in on their investment, but Dylan Field is likely to maintain strong leadership and equity, much like other modern tech founders post-IPO.

📉 What Happened to FIGMA Stock Before? Clarifying the Confusion

There has been confusion between Figma (FIG stock) and another company that previously traded under the symbol “FIG”—Fortress Investment Group, which was bought by SoftBank in 2017 and delisted.

This confusion has led to investors mistakenly searching for “figma stock” on platforms like Robinhood or E*TRADE, only to be redirected or find no listing. Once the IPO occurs, this confusion should clear, and “Figma stock” will take its rightful place under the newly minted FIG ticker.

📈 Why You Should Care: Market Demand for Collaborative Design Tools

The IPO market in 2025 is slowly bouncing back after the drought of 2022–2023. A company like Figma could ignite investor optimism in the SaaS sector.

Here’s why investors are excited about figma stock:

-

High switching cost for enterprise clients

-

Strong product-led growth

-

AI design integration possibilities in 2025

-

A growing need for cross-functional collaboration tools

Design is no longer a siloed activity—product managers, marketers, and engineers are deeply involved. Figma is positioned as the operating system of digital product design, and that has major implications.

💬 Market Voices: Analyst Opinions on FIG Stock

Here’s what leading voices in the tech and finance world are saying about the upcoming Figma stock IPO:

-

TechCrunch: “If Figma goes public this year, it would be one of the most anticipated IPOs since Databricks.”

-

Forbes: “Figma’s failed merger with Adobe might become a blessing in disguise—freeing it to pursue public market glory.”

-

Bloomberg Intelligence: “Figma’s ARR growth rate and sticky user base put it on par with Asana and Atlassian, and ahead in design collaboration.”

🔗 Read TechCrunch’s Figma IPO Coverage

🧠 Investing in FIG Stock: Key Risks and Rewards

Potential Rewards

-

Access to a category-defining company in SaaS

-

High growth trajectory in digital design market

-

Cloud-first architecture, built for scalability

-

Massive brand loyalty in Gen Z and Millennial product teams

Key Risks

-

Market volatility in tech IPOs post-2022

-

Potential for slowing growth as competition ramps up (e.g., Canva, Penpot)

-

Unclear profitability metrics (no public net income data yet)

While FIG stock may attract long-term investors, short-term volatility is likely.

🧮 Figma vs. Competitors: Where Does It Stand?

| Company | Focus Area | ARR (est.) | Public/Private |

|---|---|---|---|

| Figma | Design Collaboration | $600M+ | Private (IPO coming) |

| Adobe XD | Vector Design Tool | $250M+ | Public (Adobe) |

| Canva | Design for Non-Pros | $1.5B+ | Private |

| Sketch | Mac-based UI Tool | < $100M | Private |

| Penpot | Open-source competitor | N/A | Private |

With Adobe XD being slowly phased out and Sketch losing market share, Figma dominates the professional designer segment, making it a strong public market contender.

🗳️ Final Thoughts: Should You Buy Figma Stock?

If you’re a believer in SaaS innovation and the design-tech boom, then FIG stock might be worth a spot on your watchlist. However, waiting until post-IPO stabilization could help mitigate the risks of first-day volatility.

For long-term growth investors, especially those with exposure to tech-heavy portfolios, Figma stock could be the next-generation bet—akin to how Zoom and Atlassian became essentials in remote work.

External Resources

👉 Looking to stay updated beyond tech and finance? Check out our latest coverage on sports and entertainment too! Dive into the high-stakes Premier League showdown in Luton Town vs Tottenham: A Clash of Ambitions – a match that could shape the season’s momentum. And don’t miss the latest headline-grabbing development in pop culture with GloRilla Arrested: What We Know About the Felony Drug Charges, where we break down everything unfolding around the rapper’s legal case.