1. NVTS Stock News: Surge Follows Nvidia Tie‑Up

Navitas Semiconductor Corporation’s nvts stock news dominated the market after the company announced a strategic collaboration with Nvidia to deliver high-efficiency, scalable power delivery systems for next‑generation AI workloads. Shares catapulted over 130%, rising from around $1.91 to over $4.40, pushing NVTS stock solidly into positive territory for 2025.

This nvidia partnership is seen as a validation of Navitas’s position as the only pure-play power semiconductor firm focused on GaN and SiC ICs. The firm reported $83.3M in revenue and a net loss of $84.6M, yet the partnership unlocked investor enthusiasm.

2. Navitas Semiconductor Stock: Technology Breakthrough

Navitas recently unveiled a 12 kW GaN & SiC platform for hyperscale data centers, achieving 97.8% efficiency and reducing power loss by 30%. This flagship PSU supports 120 kW rack densities and accelerates their AI roadmap.

At CES 2025, Navitas showcased its 650 V bi‑directional GaNFast ICs, 8.5 kW AI PSU, and top-notch thermal modules for EV, solar, and mobile applications. These innovations position the company as a force in power conversion markets.

3. NVTS Stock Earnings Analysis

Navitas reported Q4 2024 revenue of $17.98M, missing estimates by ~6%, with EPS at – $0.06—flat year‑over‑year.In Q1 2025, revenue dipped to $14.02M (down from $23.18M year‑ago), missing again by 1.6%, while earnings remained at a $0.06 loss per share.

The company remains unprofitable, with trailing net losses of over $84M, although operating cash flows have improved slightly. Analysts caution that earnings consistency will hinge on execution and scaling.

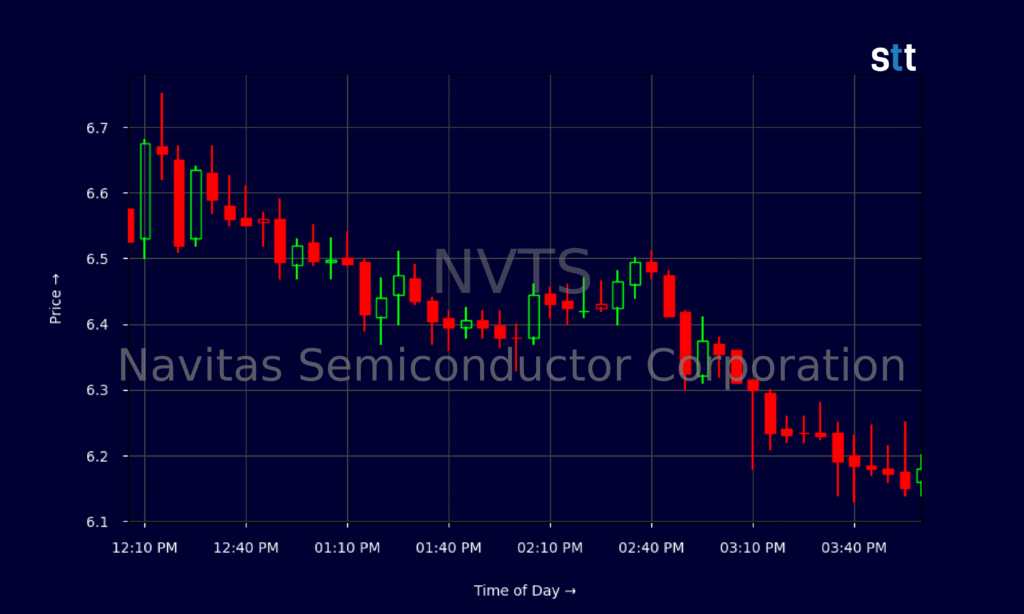

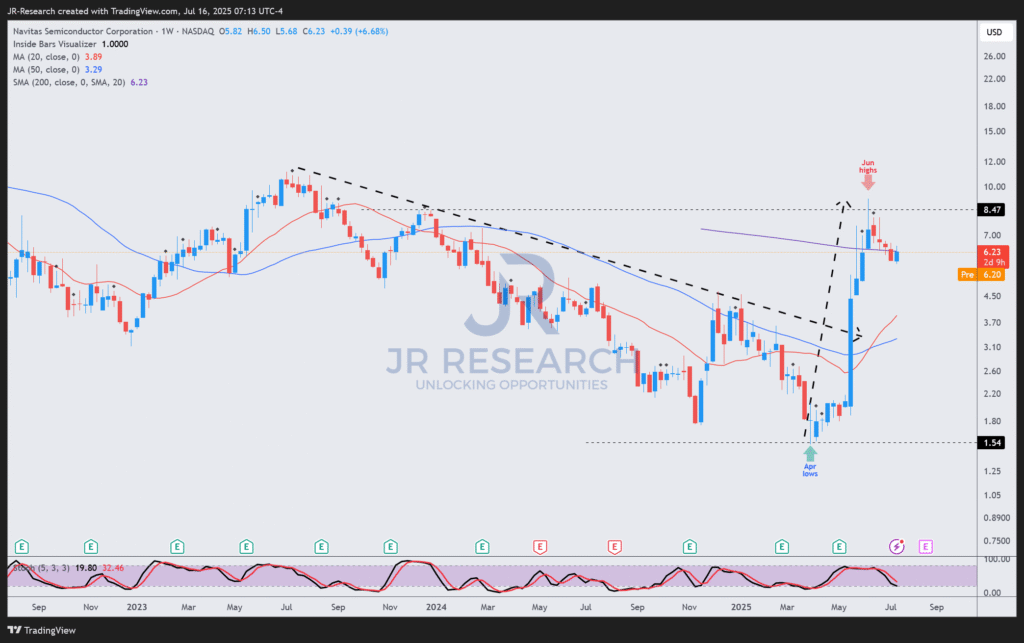

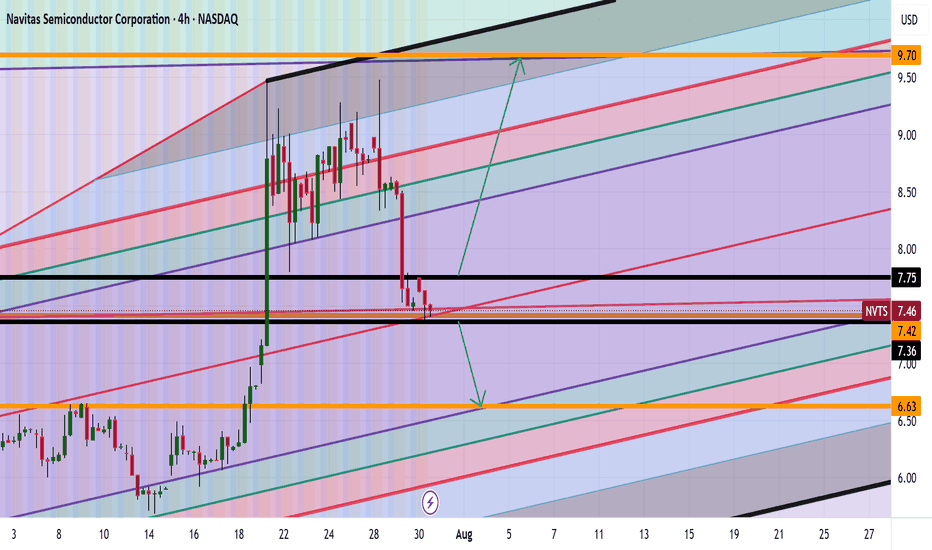

4. Technical View: NVTS Stock Charts & Patterns

Technical analysis reads mixed—some patterns suggest a head-and-shoulders correction pointing toward $3–$3.50 targets, while bullish Elliott wave and harmonic projections aim as high as $20 and beyond.

Recent charts show breakout trends above $7.80 could propel nvts stock toward $9–$9.70, while failure below $7.30 might lower price toward the $6 range.

5. Strategic Catalysts & Risks

Catalysts:

-

Nvidia partnership offers credibility and long-term revenue potential.

-

Expansion into EVs, AI data centers, solar and mobile design wins, backed by a ~$1.25B customer pipeline.

-

Rolling out 200 mm GaN production with PSMC, enhancing supply resilience and cost competitiveness.

Risks:

-

Negative EPS and revenue misses raise concerns over execution risk.

-

Valuation appears stretched: forward EV/Revenue multiple sits near 16.5×, with high short interest (~32%) and resistance near $9.20.

-

Challenges include supply chain hurdles, competition from firms like Wolfspeed, ON Semiconductor, and macroeconomic headwinds.

6. NVTS Stock Future Outlook & Price Targets

Reddit analysis and modeling envision scenarios from conservative to bullish:

-

Bear Case: $300M revenue by 2030; P/S ≈ 5× → stock $7–$8

-

Base Case: $500–600M revenue; 8–10× P/S → $20–$30

-

Bull Case: $900M–$1B revenue; 10–15× P/S → $45–$75

Progress toward profitability by 2027–2028 and major deals (EV, cloud partners) will likely determine future valuation squeezes

7. Recent Corporate Moves and Insider Actions

Navitas revamped its governance: Richard Hendrix became Board Chair, Dr. Ranbir Singh chairs the Executive Steering Committee, and CTO Daniel Kinzer stepped down from executive duties—but remains advisor.

Insider activity is notable—recent CFO and director share dispositions hint at diverging sentiment among leadership, potentially influencing investor outlook.

8. The Bottom Line for Investors

-

NVTS stock news is dominated by high-profile collaborations and rapid technological strides.

-

Short‑term volatility persists due to unprofitable earnings, valuation pressure, and looming macro risks.

-

Long‑term thesis hinges on execution across AI data center, EV, and clean‑tech markets—coupled with sustained partnerships like Nvidia.

-

Technical indicators offer trading anchors: breakout above $7.80 could signal upward moves; breakdown below $6–$7 may expose downside risk.

Potential investors should monitor upcoming Q2 earnings call on August 4, 2025, and participation in several semiconductor industry conferences remains key events to watch.

9. Suggested Paragraph with Internal Link Placement

(This paragraph allows you to insert internal links)

For further reading on visionary figures in entertainment and unexpected journeys through fame and controversy, check out our deep dives into James Gunn: The Visionary Behind Superman’s 2025 Reboot and Azealia Banks and Conor McGregor – A Saga of Controversies.

💡 External Links to Include

-

Link to Investopedia piece on the Nvidia partnership

-

Navitas Corporate Press Releases or CES 2025 covera